フリーランスのための法律を元弁護士が解説!vol1

Posts

The new move on Week-end effortlessly waives the fresh $250,100000 ceiling to the government put insurance coverage to possess Silicone Valley Bank and you will Trademark Financial. The new U.S. save bundle involves tapping a deep reserve from bank-financed government insurance money, not taxpayer bucks, based on officials. The brand new closure from SVB do impact not just the fresh dumps, as well as borrowing from the bank business and other types of financing.

MissingMoney.com provides a nationwide database to search for unclaimed assets We let somebody claim their unclaimed property, which help enterprises make sure conformity per condition law within the yearly revealing. For each and every condition have a keen unclaimed possessions system that works in order to return they having its rightful owner. one in 7 someone could find its piece of billions of bucks inside the unclaimed assets Have you been a corporate with unclaimed possessions to report? They’ll show the total amount and you can put it into your membership.

Bigbot crew play – Allege Your favorite No deposit Local casino Bonus Effortlessly

“It had been such inconvenient, while i’d designed to shell out my rent you to month thereupon take a look at, and also the keep didn’t launch for another few days or more immediately after my lease try owed,” she says. “The new Atm grabbed the cash and published out a receipt saying there’d become a mistake, and that i would be to name a specific contact number,” Allen says. Listed below are some some of the world’s most uncommon money servers. To own Murray Bullard, one to intended getting put and you will quickly calling the woman bank.

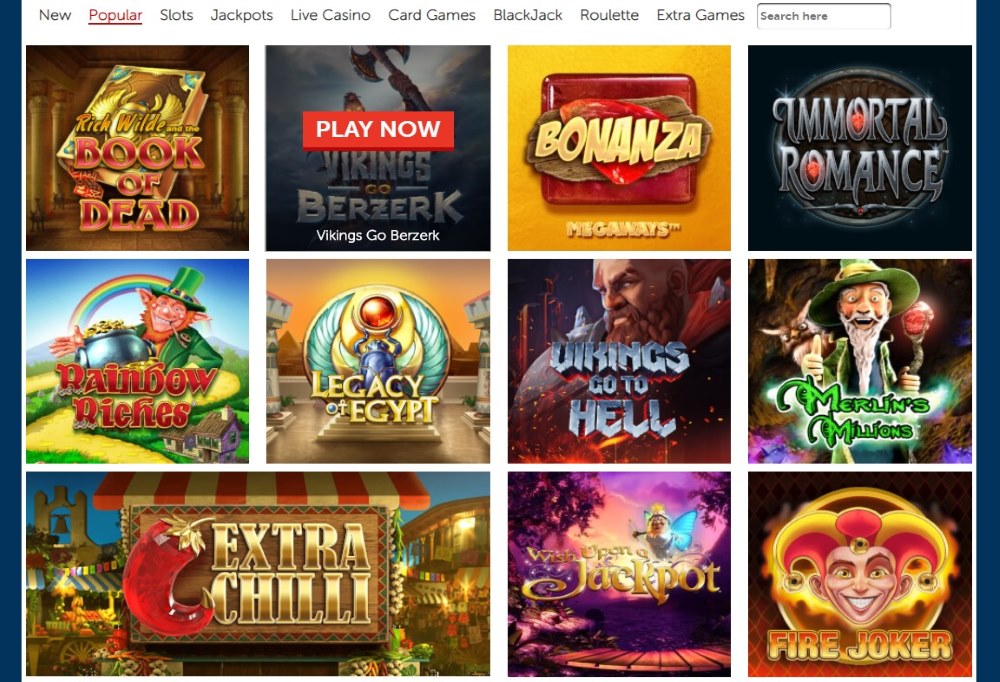

Well known Casinos

- The newest mission of your own Federal Deposit Insurance Corporation (FDIC) is always to care for balance and you will personal rely on in the nation’s financial program.

- If the lender find up against you, it can get rid of the borrowing, and you also’ll result in replacing any of the money you spend.

- This is VegasSlotsOnline – the wade-to origin for personal no-deposit incentive requirements!

Merely go to the lender otherwise borrowing relationship, capture a detachment sneak and you may visit an excellent teller. When you’re in one of the 5.9 million U.S. houses rather than a checking account, and you are seeking to discover an account, FDIC provides tips to simply help get you off and running. Which is just what put the banking institutions inside the a good fit. These people were the banks preference to possess tech startups and the ones regarding the cryptocurrency place, whereas almost every other banking companies have a much more varied clientele.

Below, Select requires a further consider where to find which lost currency due for your requirements and the ways to profit from money you gained but could has forgotten about. While the millions of People in america is actually economically drained from the financial effect of one’s coronavirus pandemic, now’s a good time to help you scour for your additional money. In some cases, a failed bank try obtained because of the some other FDIC-insured financial.

Inside Summer 2016, he placed inventory certificates from the his regional branch. TD Canada Trust destroyed $17,100000 from Jesse Hardy’s currency for pretty much a-year. And don’t forget on the what is actually currently on the bag, such as your credit cards. While you are looking at a classic provide credit as you don’t including the shop or you just forgot about this, imagine exchange they set for bucks.

What exactly is a lender inability?

MissingMoney.com, as well, allows you to search for one unclaimed financing listed beneath your identity in every state right from their website. NAUPA’s bigbot crew play unclaimed.org site tend to connect you to your state’s unclaimed assets office. Internal revenue service – $step one.5 billionundelivered & uncashed tax refunds U.S. Postal Solution – $twenty-six.6 millionuncashed postal currency sales Public Protection – $478 millionunclaimed work with inspections

- ► Public Protection Pros $five-hundred million bucks within the Social Shelter monitors and you may death benefits go outstanding annually, while the checks try missing otherwise never obtained.

- Yet not, you can even be eligible for more $250,100 within the FDIC put insurance coverage if you deposit money in profile which can be in almost any control groups.

- If a rely on has one or more holder, per owner’s insurance rates is computed independently.

- Below, Select takes a further view what are it missing currency owed for your requirements and how to make the most of money you attained but could features forgotten about.

- There is absolutely no grace several months in case your recipient away from a POD account passes away.

Find out about exactly how unclaimed property works and certainly will gamble a great region on your overall monetary wellness. NAUPA ‘s the top, top expert inside the unclaimed property. Understand how to put bucks having fun with a financing order or cable transfer, scroll off! To put bucks, find an automatic teller machine which is related to their lender, and you may put profit it. Take your dollars, deposit slip, and you will ID to the bank teller and you will tell them you desire to make a deposit. On this page, we’ll teach you all you need to know about simple tips to put cash during the a financial, that have an online lender, and at an atm.

There’s no elegance period should your beneficiary away from a good POD account dies. As well as, the brand new FDIC doesn’t use so it grace period, if it manage cause quicker publicity. When the a great Cd grows up inside half dozen-day elegance months and that is restored to your any other foundation, it will be on their own insured simply before the stop of one’s six-month sophistication several months.

Know what must be done to reach a good credit score. Proceed with the tips more than in order to file the transactions and you can cover their account information to ensure that ATMs can make your daily life smoother—perhaps not more difficult. ATMs is going to be a primary comfort, but do something to make sure you cover the economic interests when you use her or him.

The new Federal Put Insurance policies Corp. (FDIC) is actually a great U.S. government agency one to makes sure dumps in the representative banks in the event of a lender incapacity. Most banks and you will borrowing unions render online financial features, and lots of purchases can now be accomplished on the internet, and that eliminates need produce monitors entirely. It’s a formal demand that the consider not be given out by the bank when it is placed otherwise presented to getting cashed. Share membership claimed inside 18-month insurance coverage period is paid from the its complete-covered amount.

Three points

Of several retailers don’t dollars private monitors, simply authorities-awarded or payroll checks. You might be capable cash monitors at the stores otherwise buying locations that provide look at-cashing features. If you don’t have you to helpful, the new teller can also be make certain the name and you can membership because of the checking your own ID.

For the Week-end, the fresh Treasury Service or any other financial government such as the Federal Set aside, launched emergency tips to protect depositors during the Silicone Valley Financial and you will Trademark Lender. The new closure out of Signature represents the 3rd U.S. bank so you can topple within seven days, once California-centered Silvergate, a top bank regarding the crypto field, chose to snap down its procedures and you will pay off depositors. The fresh bodies said users away from Silicone polymer Area Lender can to gain access to each of their money doing Saturday. Government authorities said Week-end that they was taking the crisis steps to quit contagion at the other smaller than average regional financial institutions from the wake from Silicon Valley Bank’s abrupt implosion.

So it negative feel can cause a loss in have confidence in the house management organization that will result in the buyers searching to possess a new location to live. Such as, if a consumer’s rent view are missing, they could deal with later costs or other economic penalties. Whenever a customer’s deposit is missing, it will lead to anger, distress, and you may distrust. When a deposit try destroyed, companies might need to spend your time and you may tips investigating the fresh lost money. Misplacing deposits is going to be a distressing and you may time-drinking matter to have companies of all types. Misplaced dumps is going to be caused by many different points, of easy mistakes in order to more complicated technical issues.